Russia

country profile

Russia is a key target market for tourism sector in Azerbaijan the importance of which is currently growing witnessing the rise in the number of guests after the pandemic period. In 2024, Azerbaijan was in the top 5 countries visited among the CIS countries by Russian tourists. Russians appreciate Azerbaijan’s history, culture, nature, hospitality, culinary, wine, ski, health treatment related opportunities, its modern look and ancient soul.

Summer holidays – 01.06 – 31.08

Autumn holidays – 28.10 – 05.11

Winter holidays/New Year Celebration – 30.12 – 12.01

Spring holidays – 22.02-01.03, 05.04 -13.04,12.04-19.04 (depend on school program)

May holidays (Russians combine sequent coming holidays on May 1st and 9th for vacation) – 01.05 – 11.05

The average age of a Russian tourist is 39 years. Most Russian travelers (64%) were between the ages of 30 and 50.

Sun and Beach Holidays: Popular destinations include Turkey, UAE, Thailand, Georgia (mainly Abkhazia region), Egypt followed by Vietnam, Maldives, Sri-Lanka.

City Breaks: as a weekend tour or during the transit flight using Baku as stopover destination. At the moment AZAL has a special offer: for connections from 8 to 24 hours free hotel accommodation is offered (booked and reconfirmed with airline company in advance).

Cultural Holidays: High interest in museums, historical sites, and landmarks.

Adventure and Sports Holidays: Activities like skiing as reason number one, diving, hiking, cycling, golf.

Gastronomical Tours: Increasing interest in food and wine tours.

Wellness and Medical Tourism: Special interest in medical procedures and SPA treatments. High class clients are looking for detox, weight loss programs.

Events and festivals: High interest in musical festivals (especially for singers and groups from EU and USA), sport events including Formula 1, UFC and etc.

According to the latest survey, 50% of travelers prefer to travel with family and children, 26% as couples and 14% alone. The most popular destinations among responders are sea resorts (64%), 13% choose trip to mountains, 11% choose historical places and 7% choose trips by car.

Language: Russians are more likely to travel to destinations where Russian language is widely spoken, most of clients over 60 do not speak foreign languages.

Good ski slopes for winter ski tourists and good beaches for summer leisure vacations.

For summer family holidays Russian tourists prefer all inclusive meals.

Cashless payment: Due to current sanctions on international payment cards Russians use local payment system and prefer destinations where they are applicable. Due to impossibility of international payments, tourists more and more planning their trip via travel agencies. Payments by Russian cards MIR (of main Russian banks) is possible in main touristic locations in Turkey and Iran (Turkey – via QR codes, Iran - via cards).

Detailed Planning: Research extensively using online travel agencies, social media, and word-of-mouth.

In 2024, Russian tourists spend on average $2,300 per person per foreign holiday.

Families

Seniors

Couples

Millennial generation

Social media (VKontakte, Telegram)

Friends’ recommendations (Word of Mouth)

Travel agencies and tour operators

OTA and aggregators (like Ostrovok, Yandex Puteshestvie, Ozon Travel, Aviasales, OneTwoTrip).

Magazines (printed and online)

TV programs/ Radio

Due to current unstable circumstances Russians (individual travelers) plan their vacations late. Short-term trips to close destinations, especially during weekends are also demanded by Russians to get away from business routine. However, the Russians who travel via travel agents purchase packages up to 2-3 month prior to the travel time.

Travel agencies (off line bookings)

OTA/Aggregators (online bookings)

Direct bookings with accommodation and other services providers

Online travel agencies and aggregators: Ostrovok, Yandex Puteshestvie, Ozon Travel, MTS Travel, Tutu, OneTwoTrip.

Tour operators (important for Azerbaijan):

Mass market: FUN&SUN, PAC Group, Space Travel, Russian Express, ICS, Evroport and others.

FIT (mainly): Jet Travel, Panteon, Vand, Sodis, Karlson Tourism, PAKS and others.

Specialized tour operators (active sports, wine, golf, MICE)

In 2024, the average duration of the main vacation among Russians was around 7 days.

FUN&SUN

Biblio-Globus

ANEX Tour

Pegas Touristk

Russian Express

PAC Group

Intourist

Space Travel

PAKS

Tez Tour

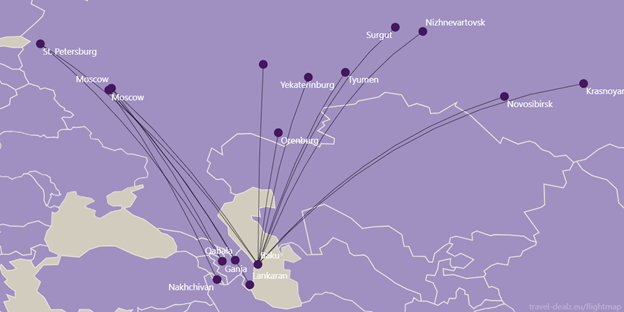

Updated information about flights can be found on the interactive board of the State Tourism Agency of the Republic of Azerbaijan.

Moscow International Travel & Tourism Exhibition (MITT) every March

Otdykh Leisure every September

Luxury Travel Market (LTM) every September/February

MICE Excellence

Forum “Puteshestvyi”

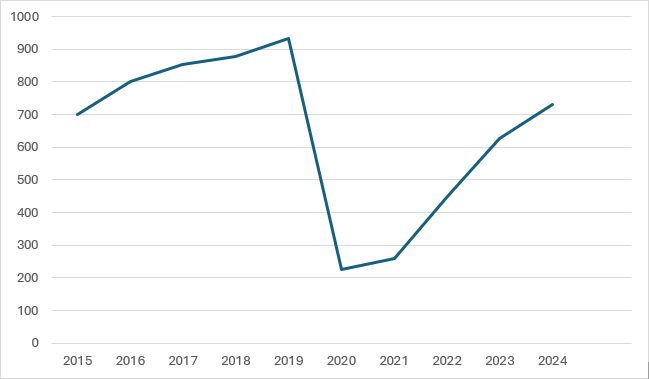

The number of Russian arrivals to Azerbaijan increased steadily from 685,555 in 2015 to 932,984 in 2019, representing an overall growth of approximately 36% over this period.

From 2021 to 2024, the numbers started to recover post-pandemic, with arrivals increasing by 14,5% in 2024 compared to 2023, indicating recovery trend.

Source: State Migration Service

46% of Russian visitors to Azerbaijan traveled for leisure and entertainment, while 24% came to visit friends and family.

The average Russian tourist spends 1,577 AZN in Azerbaijan, with 42% of their budget allocated to transport, followed by food (22%) and accommodation (17%). Russians are among TOP 10 for travel expenses (TOP 5 are Chinese, USA, Germany, UK and France).

Length of Stay: 41% of Russian visitors stayed in Azerbaijan for 4 to 7 nights, while 38% stayed for 1 to 3 nights.

The most visited regions by Russians in Azerbaijan are Baku, Guba/Gusar, Gabala, Sheki, Ismayilli, Ganja and Naftalan.

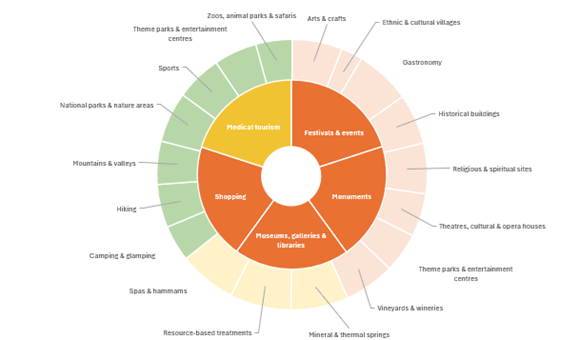

Russian tourists visiting Azerbaijan exhibit a strong preference for a variety of cultural and historical experiences, encompassing architectural landmarks, nature tourism, culinary delights and wine, festivals, and events.

Products of Azerbaijan that connect to the Russia market can be grouped into “Fits all” – products that all first-time visitors should see or experience, “Add-ons” – products that can be seen or experienced with longer or repeat visits, and “Tailored” – products that are considered of specific relevance to the market.

|

|

Fits all |

Add-on |

Tailored |

|

Monument & Historical Buildings

|

|

|

|

|

Museums & galleries |

|

|

|

|

Medical Tourism |

|

|

|

|

Festivals & Events Tourism

|

|

|

|

|

Cultural & Culinary Experiences

|

|

|

|

|

Sports

|

|

|

|

Russian tourists exhibit lower interest in ethnic and rural tourism and birdwatching activities in Azerbaijan.

According to Rosstat, Russia’s outbound tourism market reached around 27.3 million in 2024, which is roughly a 2 million increase compared to 2023. If this trend continues, an additional growth of 2.5 to 3 million is projected for 2025.

Russians can expect further shifting of the destination vector towards Asian countries, including for event-based tourism. The interest in non-standard travel options is growing as well. For instance, the demand for caravanning or RV (recreational vehicle) travelling is on the rise but still it’s low compare to other countries.

Short city breaks/ weekend trips to Baku and regional city are promoted for high-end segment from big-sized cities, such as Moscow and St. Petersburg. Cooperation with leading Tour operators based in Moscow and St. Petersburg is preferable.

Long-term travel to regional cities and Baku for middle-end segment from secondary cities, such as Ekaterinburg, Kazan, Samara, Novosibirsk, Krasnodar, and others. Cooperation with Travel Agencies in regional cities is preferable.

Implementation of marketing strategy for Russian market can be realized by focusing on high-end and middle-end traveller segments targeted upon on geographic focus.

The best time for booking travel is starting from March for Summer season and starting from September for winter season.

Currently Baku is considered as a stopover destination for Russians traveling to Europe. Stopover duration in Baku is 2-3 days

MICE potential of destination can be promoted via related marketing channels and via kick back programs similar to other competitor destinations.

Jalal Ismayilov, Head of Branch office in Russia.