April 2025

Market specific information

Significance for Azerbaijan

Germany is Europe’s largest outbound travel market, making it crucial for Azerbaijan's tourism sector. ATB is focused on increasing German leisure and business travellers by highlighting Azerbaijan's rich culture, natural beauty, hospitality, and cuisine. Germany's high spending power and travel priority, with the tourism market projected to grow from USD 95.3 billion in 2022 to USD 241.4 billion by 2032, present significant opportunities for Azerbaijan. Germans seek detailed travel information and prefer sustainable options, aligning well with Azerbaijan’s offerings.

Main holidays period

- End of April – Easter time

- May – 1, 9, 19, 20, 30 bank holidays in different states

- July – August – The summer period (school holidays)

- Christmas – New Year – End of December

Tourist Information

Profile of the tourist

German tourists are predominantly aged 25-54, with a significant number of retirees (65+) travelling frequently.

Holiday types

- Sun and Beach Holidays: Popular destinations include Spain, Italy, and Greece.

- City Breaks: Enjoyed both domestically and within Europe.

- Cultural Holidays: High interest in museums, historical sites, and landmarks.

- Adventure and Sports Holidays: Activities like hiking, cycling, and skiing.

- Gastronomical Holidays: Increasing interest in food and wine tours.

- Wellness and Medical Tourism: Interest in spa treatments and medical procedures.

- Eco Holidays: Value sustainable and eco-friendly travel.

- Cruises: Popular among older travellers, especially river cruises along the Rhine and Danube.

- LGBTQIA+ Holidays: Seek inclusive travel experiences in LGBTQIA+ friendly Germany.

Preferences

- Sustainability: Prefer eco-friendly options and are willing to pay more.

- Detailed Planning: Research extensively using online travel agencies, social media, and word-of-mouth.

- Value for Money: Seek good value and transparent pricing.

- Safety and Security: Prioritize safe and stable destinations.

- Comfort and Quality: Favor high-quality accommodations and services.

Average Spending

In 2024, German tourists spent an average of approximately €1,648 per international trip, an increase from €1194 in 2023.

Key travel audience

- Families

- Seniors

- Couples

- Friends’ groups

Information source

- Social media (Instagram, Facebook for Millennials and Gen Z)

- Friends’ recommendations (Word of Mouth)

- Travel agencies

- Online travel agencies (OTAs)

Planning and travel decision period

Germans usually book their vacations 6 months before the holiday. However, the decision-making process can vary:

- For major holidays or international trips, they might plan and book up to a year in advance.

- For summer vacations, bookings are typically made 6 months ahead.

- Short-term trips or last-minute bookings are also common, especially in response to fluctuating travel prices and availability, with some bookings made only 14 days in advance due to rising prices in Europe.

Means for purchase

- Online bookings (49.6%)

- Face-to-face bookings (36.1%)

- Travel agencies

- Direct bookings with accommodation providers

Distribution system

- Online travel agencies (OTAs): Expedia, Opodo

- Specialized providers: Booking.com, Hotels.com, Airbnb

- Most visited travel and tourism websites: bahn.de, booking.com, tripadvisor.de

Special interest tourism

- Campervans and RVs: Companies include Reisebine, Camperbörse, Alacampa

- Study and education trips: Studiosus, Gebeco (including youth/adventure travel with GoExplore brand)

- Luxury/Premium: Art of Travel, Design Reisen, Windrose, Kugler Reisen

Travel duration

In 2024, the average duration of the main vacation among Germans was around 13 days.

Travel trade information

List of leading tourism companies

- TUI Group

- DER Touristik Group

- FTI Group

- Schauinsland-Reisen GmbH

- Lufthansa Group

- Emirates Group

- Expedia Group

- Booking Holdings Inc.

- American Express Global Business Travel

- CWT (Carlson Wagonlit Travel)

Direct flights

Updated information about flight connectivity can be found on the interactive board of the State Tourism Agency of the Republic of Azerbaijan

Major events in the market

- Internationale Tourismus Börse (ITB Berlin) every March

- IMEX Frankfurt, every May

German tourists in Azerbaijan: Key insights

Arrivals

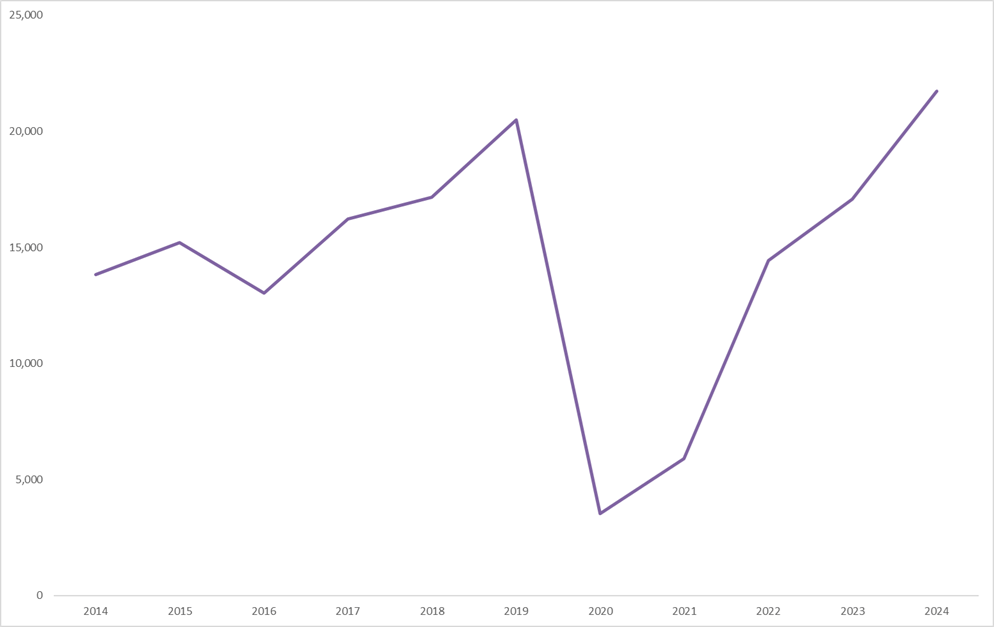

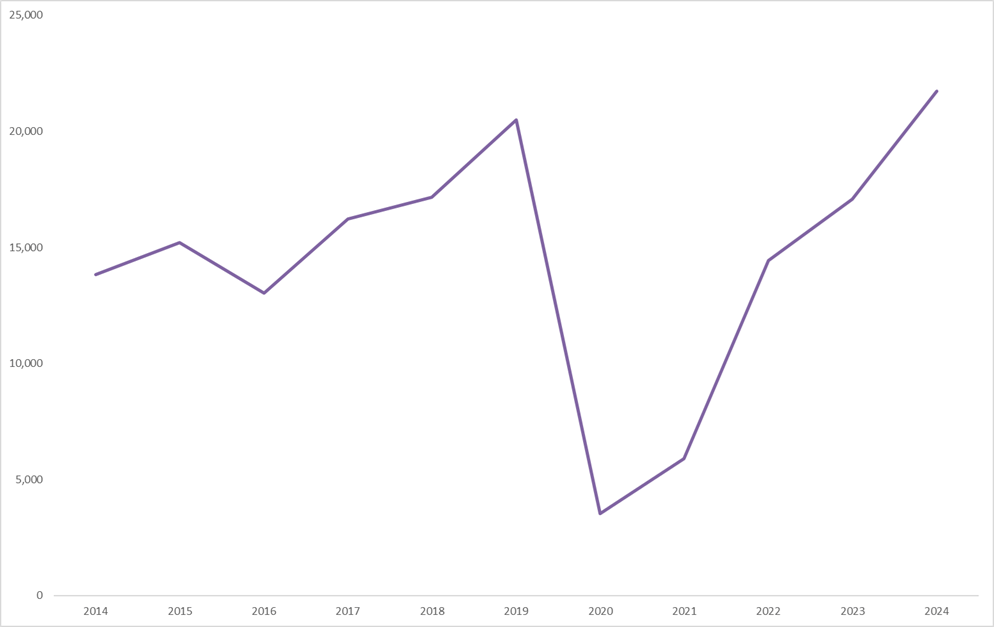

The number of German arrivals to Azerbaijan increased steadily from 13,838 in 2014 to 20,494 in 2019, marking an overall growth of approximately 48% over this period. In 2020, due to the COVID-19 pandemic, arrivals dropped sharply by around 83%, reaching only 3,529 visitors. From 2021 onwards, the market showed a strong recovery trend. By 2024, arrivals are expected to reach 21,730, showing a further 27% growth over 2023 and surpassing pre-pandemic levels, indicating a full market rebound.

Source: State Migration Service

Purpose of Visit

61% of German visitors to Azerbaijan travel for leisure and entertainment purposes, while 22% visit for business reasons.

Average Spending

The average German tourist spends 2,070 AZN in Azerbaijan. Breakdown of their expenses:

- 42% on transport

- 22% on accommodation

- 21% on food

- 9% on shopping (goods, souvenirs)

Length of Stay

In 2024, 44% of Germans stayed in Azerbaijan for 1-3 nights, while 33% stayed for 4-7 nights.

Popular Regions

The most visited regions by Germans in Azerbaijan are Guba, Gabala, Sheki, and Ganja.

Tourist Preferences and Interests

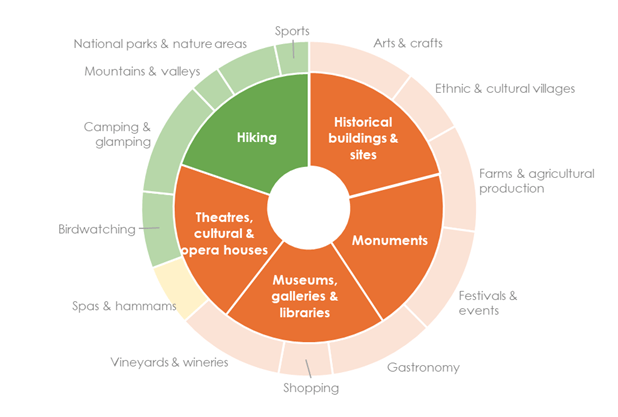

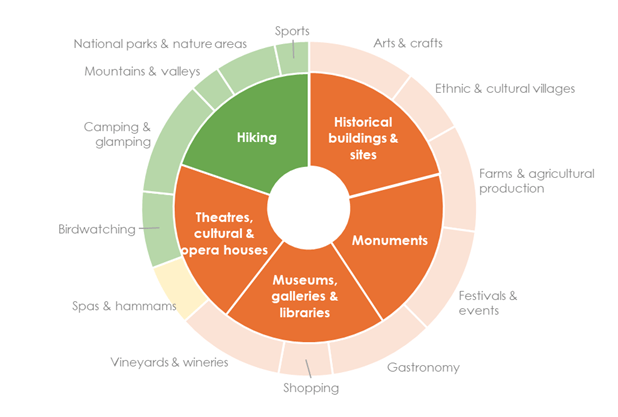

German tourists exhibit a strong preference for a variety of cultural and natural experiences connected to the ATB product sub-categories of historical buildings, monuments, museums, galleries & libraries, theatres, cultural & opera houses, and hiking.

Products of Azerbaijan that connect to the German market can be grouped into “Fits all” – products that all first-time visitors should see or experience, “Add-ons” – products that can be seen or experienced with longer or repeat visits, and “Tailored” – products that are considered of specific relevance to the market.

|

|

Fits all

|

Add-ons

|

Tailored

|

|

Monuments

|

- Haydar Aliyev Centre

- Maiden Tower

- Diri Baba Mausoleum

- Ateshgah fire temple

- Flame Towers

|

|

|

|

Historical Buildings and Sites

|

- Gobustan petroglyphs

- Baku Old City

- Kish Alban Church

- Sheki Khans Palace

- Sheki Khans Mosque & Cemetery

- Sheki Upper Caravanserai

|

- Yanardag burning mountain

|

- Victor Klein House (Goygol)

- Goygol Lutheran Church (Goygol)

- German wine cellars (Shamkir)

- Siemens Bridges (Ganja)

- Siemens building (Ganja)

|

|

Hiking

|

- Shahdag National Park hiking trails

- Hirkan lakeside walks & local chaykhanas

|

- Goygol National Park mountain lakes hiking trails

|

- Trans Caucasus Trail

- Laza-Laza hiking trail

- Zengilan National Park hiking trails (Nakchivan)

- Gadabay - Dashkasan

|

|

Museums, Galleries & libraries

|

- Heydar Aliyev Center

- Shirvanshah Museum

- Carpet Museum

- National History Museum

- Gobustan Mud Volcano Centre & Museum

|

|

- Shamkir Lutheran Church museum

|

|

Ethnic & Cultural Villages

|

- Sheki old city (national heritage)

- Khinalig village (Caucasian-Albanian)

- Nij village (Udi / Caucasian-Albanian)

|

- Basqal village (national heritage)

- Sim village (Talish)

- Ivanovka village (Russian Molokan)

- Red village (Mountain Jews)

|

- Shamkir City German Quarter

- Goygol City German Quarter

|

|

Arts & Crafts

|

- Carpet weaving masterclass

- Lahij coppersmith masterclass

- Sheki Shebekhe masterclass

|

- Mugham centre performance

|

- Basgal Kelaghayi masterclass

|

Additional information

German outbound tourism forecast

The German travel industry anticipates a robust year in 2025, with the Deutscher Reiseverband (DRV) forecasting a 6% increase in travel expenditures, reaching €85 billion. This growth is driven by strong demand for both package and individually organized holidays, particularly to Mediterranean destinations, long-haul locations, and cruises. Notably, early bookings have surged, indicating a shift towards planning vacations well in advance.

Top tips for the German market

- Relationship management is crucial; loyalty and strong relationships with wholesalers are important.

- The best time for sales calls is late March after the ITB event through to July.

- Email is preferred for initial and follow-up communications. Face-to-face meetings, especially during trade shows like ITB Berlin, are highly valued. Virtual meetings and video calls are also accepted. Ensure all communication is clear, professional, and punctual.

- Key market centres to visit are Frankfurt, Munich, Düsseldorf, Hannover, Hamburg, Trier, and Geldern.

Contact person

Sabina Israfilova, Regional Manager for Europe