Kingdom of Saudi Arabia

country profile

May 2025

The Kingdom of Saudi Arabia (KSA) is in the top 5 countries from where the most tourists arrive in Azerbaijan. The latest statistics show that the number of tourist arrivals from the KSA to Azerbaijan has grown. The KSA is one of the target markets for the tourism sector in Azerbaijan whose importance is currently growing, as witnessed by the rise in the number of guests, overnight stays and expenditures.

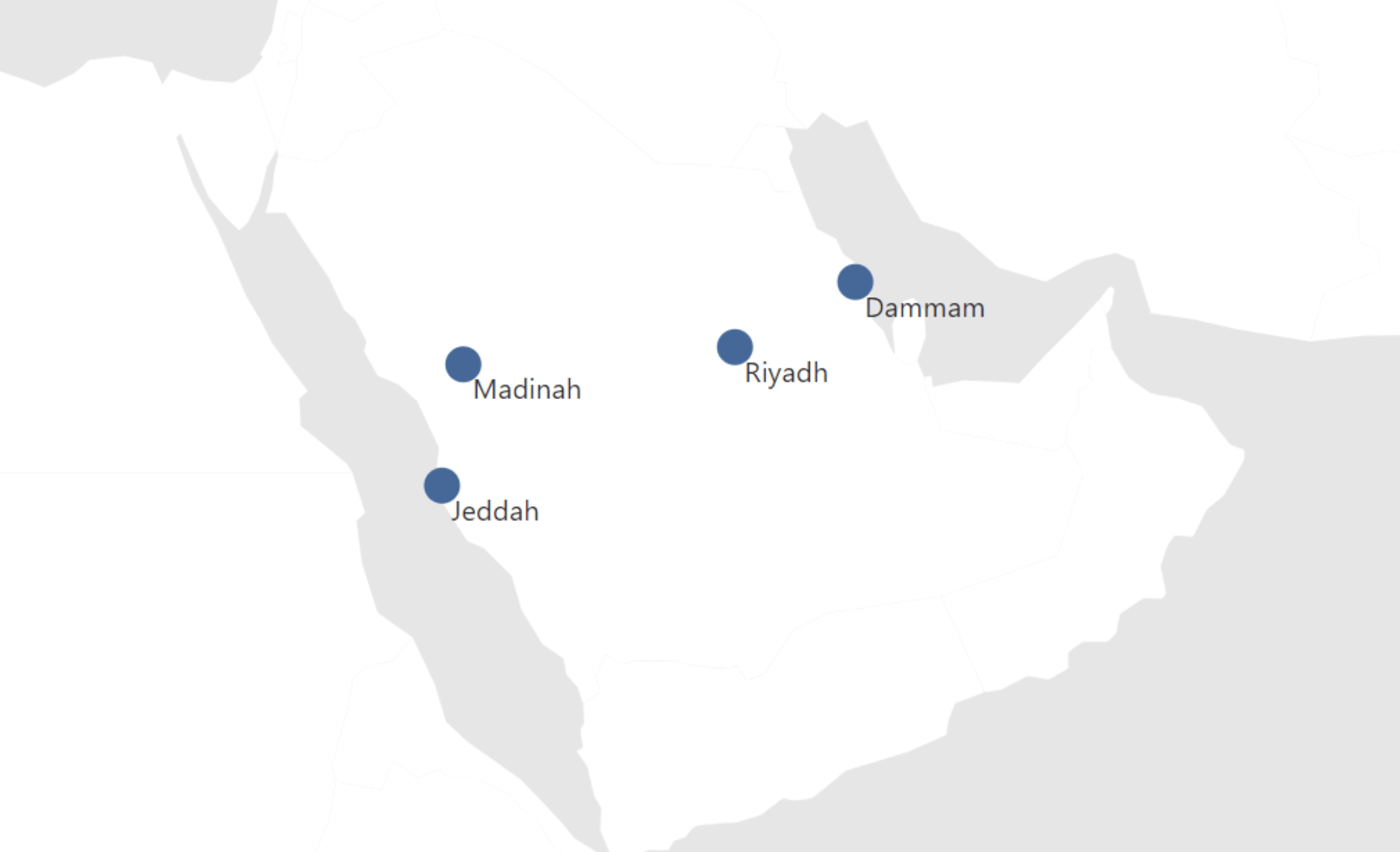

Among the main reasons for the increasing number of arrivals from the KSA are the climate, similar culture, being Muslim-friendly, the traditions and hospitality of Azerbaijan, and of course the frequency of direct flights. Another reason for the sharp increase has been the simplified visa regime for KSA citizens. The highest rate of KSA tourists is during June and July. KSA travellers can directly fly from Riyadh, Jeddah, Dammam.

Summer Break: 11 June – 20 August 2025

Winter Break: 17 December 2024 – 4 January 2025

Ramadan Break: 8 – 14 April 2025

Founding Day: 22 February 2025

Eid al-Fitr: 31 March – 3 April 2025

Arafat Day: 5 June 2025

Eid al-Adha: 6 – 9 June 2025

National Day: 23 September 2025

The average Saudi traveller to Azerbaijan generally falls within the age range of 30 to 45 years. They often travel as families, with many being married with children, making family-oriented vacations highly popular. Younger Saudis in their late 20s and early 30s may travel with friends or as couples before settling into family life. Given the typically large household size of Saudi families, with four or more members, there is a strong preference for spacious accommodations and family-friendly destinations. Their travel preferences share similarities with their neighbours in the Middle East but also reflect unique preferences and cultural influences.

Luxury Travel: high-end resorts, five-star hotels, and luxury cruises. Interest in exclusive experiences, such as private tours, gourmet dining, and luxury shopping.

Family Vacations: Destinations with family-friendly activities, theme parks, and all-inclusive resorts. Destinations with safety, cleanliness, and child-friendly amenities.

Adventure and Outdoor Activities: Interest in destinations offering winter sport activities such as skiing and snowboarding. Destinations with natural beauty, such as mountains, beaches, and forests.

Wellness and Relaxation: Preference for wellness retreats, spa vacations, and relaxation-focused destinations.

City Breaks: Interest in short trips to major cities, their landmarks, shopping districts, dining, and entertainment.

Muslim-majority Countries: Preference for travel to Muslim-majority countries or destinations with a significant Muslim population, ensuring ease of access to Halal food, prayer facilities, and cultural familiarity.

Luxury and Exclusivity: Prefer high-end, luxurious experiences, and are willing to pay a premium for exclusive services.

Shopping Experiences: Enjoy destinations with excellent shopping opportunities, including high-end brands and luxury goods.

Family-oriented: Often travel with family and prefer destinations and accommodations that cater to families with children.

Safe and Comfortable: Prioritize destinations known for safety, comfort, and high standards of hygiene.

Weather Considerations: KSA travellers often look for destinations with pleasant weather, especially during the hot summer months when they prefer cooler climates.

Culinary Excellence: Appreciate gourmet dining experiences, including halal food options and international cuisine.

The average spending of a Saudi tourist abroad is relatively high compared to other travellers. Saudi tourists are known for their significant expenditure on shopping, luxury goods, accommodation, dining, and entertainment. On average, a Saudi tourist spends between $5,000 to $10,000 per trip. This amount can vary depending on the destination, duration of stay, and the nature of the trip, such as family vacations or luxury travel experiences.

Families with kids (6 to 12 people, including mates)

Couples

Friend’s groups

According to the 2023 statistics, on average, Saudi Arabians spend at least 3 hours and 1 minute a day on different social media platforms. It is a great opportunity to easily connect and engage with their target audience through these channels, more than any other method.

Social media (Instagram, Snapchat, Tiktok, YouTube)

Friends’ recommendations (Word of Mouth)

Online Travel Agencies (OTAs)

Travel agencies

Last minute booking is very popular among travellers in the GCC, with more than two in five customers purchasing their flight tickets less than a week prior to departure. In Saudi Arabia, the zero-day rush is more pronounced, with 65% of online reservations taking place within two weeks of the travel date.

Online travel agencies

Travel agencies (All-inclusive package)

Direct with airline (online)

Face-to-face bookings

Direct with the hotel (online)

• Online travel agencies (OTAs): Expedia, Agoda, Wego, Almosafer, Musafir.com, Almatar.com

• Specialized providers: Booking.com, Hotels.com, Airbnb

The average duration of travel is between 10 and 13 days. Short-stay travel is on average 3-4 nights. Those who travel with family (kids and maids) usually stay longer and choose to explore nature and the city.

Al Tayyar Group

Cozmo Travel

Almosafer

Dulaiman

Fursan Travel

Dadabhai Travel

Dnata Travel

Al Fariz International

Arjaa Travel & Tourism

Riyadh Travel Fair (May)

KBLT Congress (September)

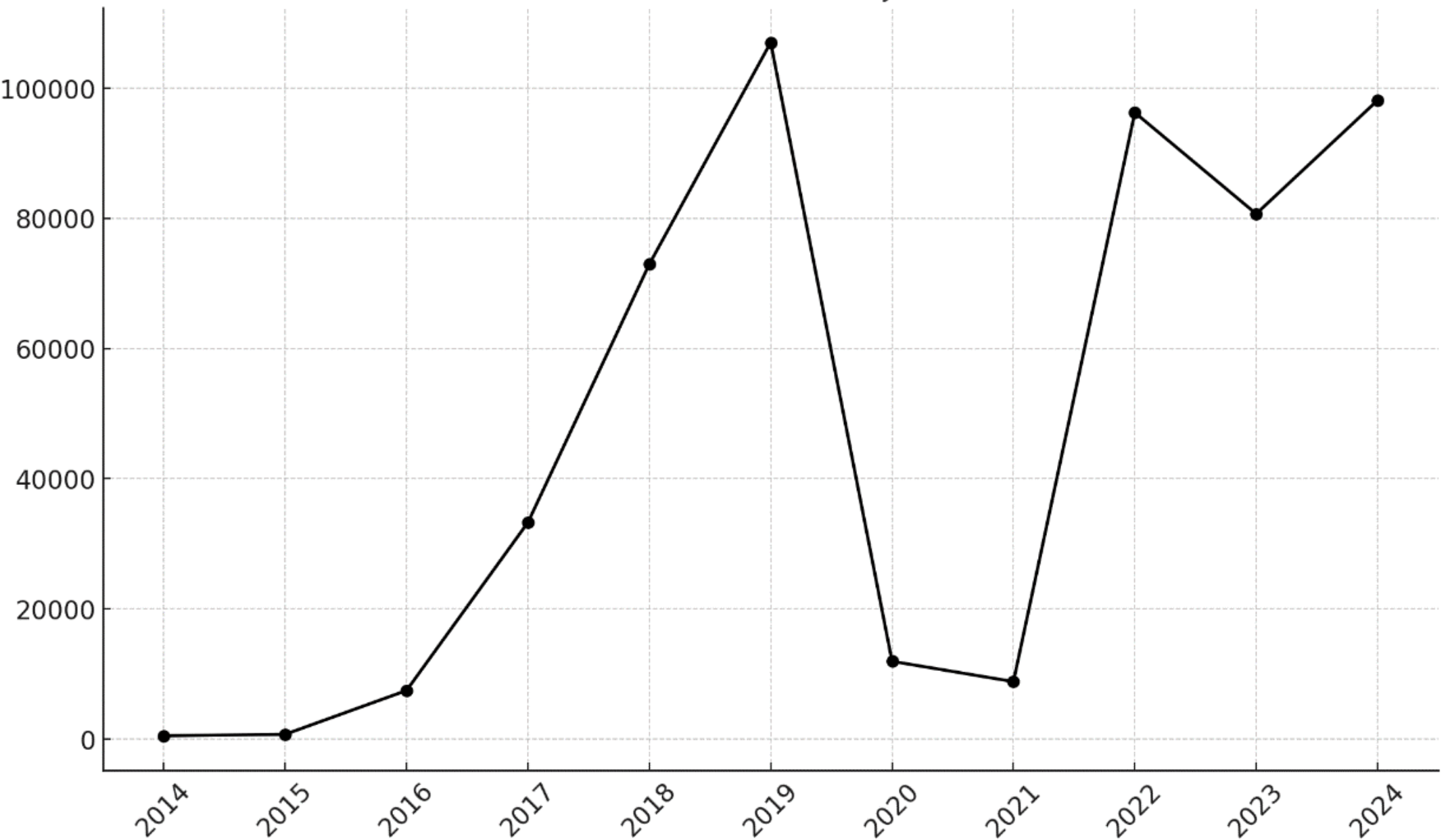

Tourist arrivals from Saudi Arabia to Azerbaijan saw a dramatic increase from just 507 in 2014 to a pre-pandemic peak of 106,994 in 2019. After a sharp decline due to COVID-19, arrivals dropped to 8,826 in 2021. However, from 2021 to 2023, the market rebounded strongly growing by approximately 991% in 2022 and by 16.1% in 2023 compared to 2022. In 2024, arrivals further increased to 98,113, showing continued recovery and sustained interest in Azerbaijan as a destination.

In 2024, 98,113 tourists from Saudi Arabia visited Azerbaijan. The majority travelled for leisure, drawn by the country's rich cultural heritage, scenic nature, and convenient travel conditions, including direct flights and simplified visa-on-arrival procedures. This marks a strong continuation of the post-pandemic recovery and growing interest in Azerbaijan as a top getaway for Saudi travellers.

The average KSA tourist spends 2.039 AZN in Azerbaijan, with 45% of their budget allocated to transport, and followed by accommodation (22%) and food (20%).

In 2025, 53% of KSA travellers stayed in Azerbaijan for 1-3 nights, while 29% stayed for more than 4-7 nights, followed by 13% of those who stayed more than 10 nights.1

The most visited regions by KSA traveller in Azerbaijan are Baku, Gabala, Gusar, Guba, and Sheki.

KSA travellers’ values nature, hospitality, cuisine of Azerbaijan as well as they highly values Azerbaijan for being suitable for halal and family-friendly travel, with a focus on accommodating the cultural and religious needs of KSA tourists.

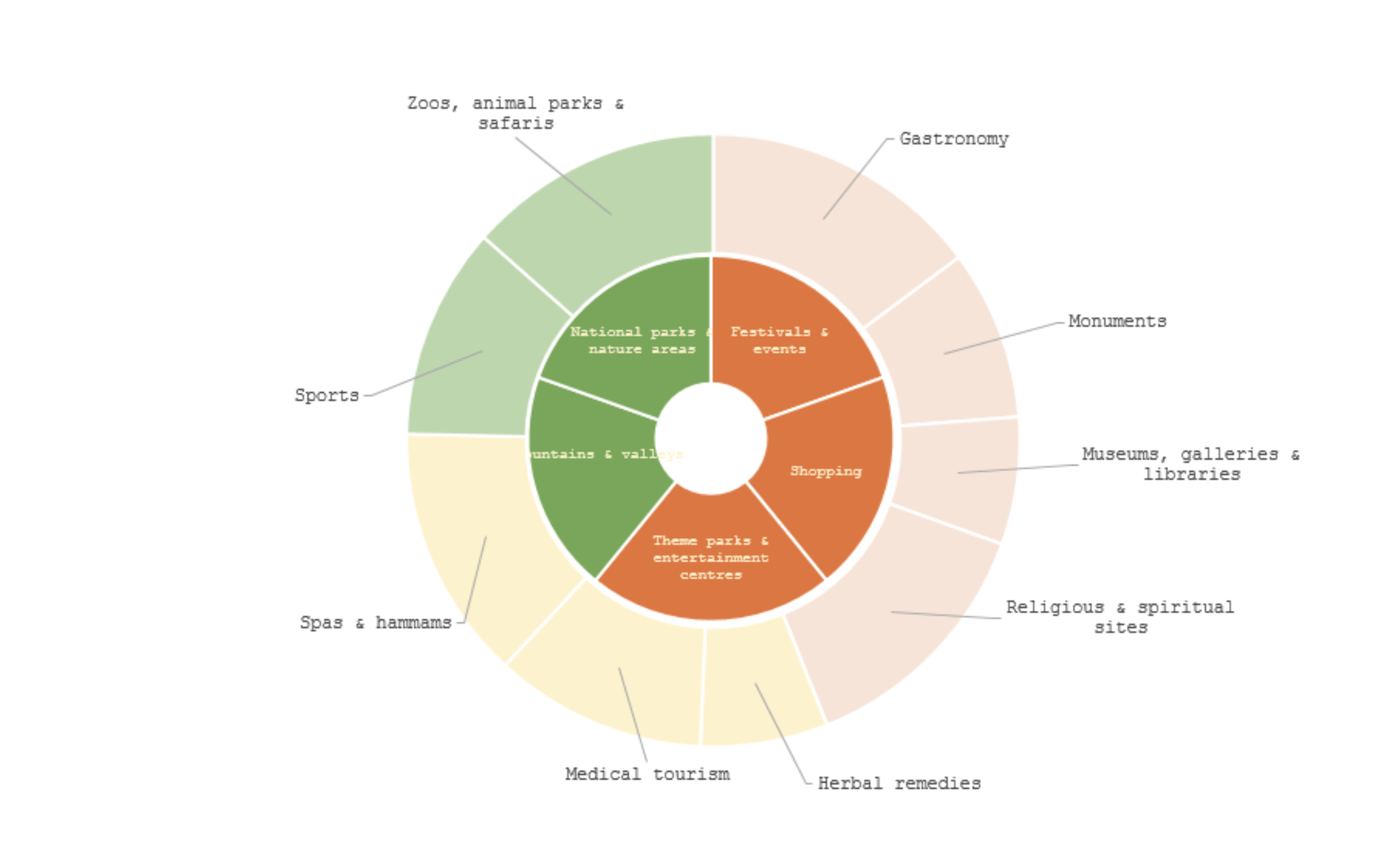

Products of Azerbaijan that connect to the KSA market can be grouped into “Fits all” – products that all first-time visitors should see or experience, “Add-ons” – products that can be seen or experienced with longer or repeat visits, and “Tailored” – products that are considered of specific relevance to the market.

|

|

Fits all |

Add-ons |

Tailored |

|

Mountains & valleys |

|

|

|

|

National parks & nature areas |

|

|

|

|

Theme parks & entertainment centres |

|

|

|

|

Shopping |

|

|

|

|

Gastronomy |

|

|

|

|

Festivals & events |

|

|

|

|

Sports

|

|

|

|

Saudi Arabia’s outbound tourism market continues to grow rapidly, with the industry projected to expand at a compound annual growth rate (CAGR) of 15.28% through 2027. While domestic and regional travel remains strong, Saudi travellers are increasingly exploring long-haul destinations such as the United Kingdom, the United States, Switzerland, Turkiye, India, and Malaysia. The UAE remains one of the most visited outbound destinations, followed closely by Turkiye and Switzerland. Today, there is a notable shift in traveller behaviour, with more Saudis seeking new and diverse experiences beyond the Middle East, presenting strong commercial opportunities for emerging and culturally rich destinations.

Relationship management is crucial; loyalty and strong relationships with wholesalers are important.

Best Time for Sales Calls: The ideal period for sales calls is from late January to February through until June, just before the peak travel season during the summer holidays and after major tourism events.

Preferred Communication: Personal touch is very important in GCC region and face-to-face meetings should be in priority, as well as zoom calls, consider that The Saudi travel trade usually works with last minute decisions or changes.

Key Market Centres to Visit: Focus on key market centres such as Jeddah, Riyadh, Dammam and Medina.

Leyla Isayeva, Regional Manager for Middle East