Italy

country profile

May 2025

As per the Azerbaijan Tourism Board’s classification, Italy falls under the Growing Connection Markets, showing consistent year-on-year growth in tourist arrivals, with numbers reaching a new peak in 2024. While not yet among the top source markets, Italy presents clear potential due to the increasing interest of Italian travellers in culture, gastronomy, wellness, and nature-based experiences. Their above-average spending, preference for authentic and high-quality travel, and increasing use of digital planning tools make them a valuable emerging segment. Strengthening visibility and partnerships in this market can contribute to long-term, sustainable growth in Azerbaijan’s inbound tourism.

April – May – Easter time

Late June – Early September – The summer period (school holidays)

December 24 – January 6 – Christmas and New Year Holidays

Italian travellers span diverse age groups, with key segments including couples, families with children, solo travellers, and people aged 55 and above. Couples and families often take 1–3 holidays per year, with a strong preference for domestic beach vacations or cultural city breaks. Younger Italians (under 40) are more likely to travel solo or with friends, seeking short getaways and experiential tourism. Seniors, particularly those aged 60–75, tend to travel with partners and prefer organized group tours, wellness retreats, or religious pilgrimages. Across all age groups, there is a growing interest in slow tourism and travel that emphasizes authenticity, comfort, and local experiences. When it comes to travel planning, 51.53% of Italian travellers prefer the flexibility of booking services separately using price comparison websites—an approach that is common for both domestic and European trips. However, for destinations outside of Europe, they tend to favour all-in-one travel packages that include both flights and accommodation. As for lodging choices, the majority (58.87%) prefer to stay in 3- or 4-star hotels, while 45.13% opt for bed and breakfasts.

Sun & Beach Holidays: T Beach vacations remain a top choice, especially during summer months. Italians often flock to coastal regions such as Sardinia, Puglia, and the Amalfi Coast. These destinations offer both glamorous resorts and hidden, untapped shores. Other popular beach destinations: Spain, Greece, Croatia.

Cultural & City Breaks: Italians have a strong affinity for cultural experiences when traveling internationally. Visits to cities rich in art, history, and architecture—such as Paris, London, and Barcelona—are particularly popular.

Mountain Hiking & Trekking: Italians enjoy hiking in the Alps, Pyrenees, and other European ranges for the combination of physical challenge and breathtaking nature. Trekking appeals especially to couples and friend groups seeking nature-based escapes.

Cycling Tours: Cycling through the vineyards of France, the valleys of Austria, or the flat countryside of the Netherlands is popular among Italian travellers who value both activity and culture. Many choose scenic cycling routes that allow stops in historic towns and regional tastings.

Ski Holidays: Skiing in Austria, Switzerland, or France is a top winter choice for Italians, especially among those already experienced on domestic slopes. They seek variety, high-quality pistes, and the prestige of top resorts abroad. These trips are often booked for long weekends or winter holidays.

Affordability: While Italians value quality, cost-effectiveness remains important. They seek good value for money, balancing comfort and price when selecting destinations and accommodations.

Recommendations: Word-of-mouth and personal endorsements significantly influence Italian travellers. Social media platforms and online reviews also play a crucial role in their decision-making process.

Safety and Security: Safety is a top priority for Italian tourists. They prefer destinations that are politically stable and have a low crime rate, ensuring a secure environment for their travels.

Culinary Experiences: Gastronomy is a significant aspect of travel for Italians. They are drawn to destinations that offer authentic and high-quality food experiences, often seeking out local cuisines and culinary traditions.

Cultural Appeal: Italian travellers are interested in destinations rich in history, art, and culture. They often engage in activities such as visiting museums, historical sites, and attending cultural events.

According to ISTAT and market analyses, Northern Italians tend to travel more frequently, prefer longer trips, and show greater interest in organized, long-haul, and culturally rich destinations, often using collective transport such as flights and trains. Southern Italians, on the other hand, travel less frequently, prefer shorter, budget-friendly trips closer to home, favouring destinations like Albania, Puglia, and other Mediterranean regions, typically using private cars and staying in private accommodations. Online search data confirms these trends, with Sardinia ranking as the top domestic destination for Northerners, while Puglia leads for Southerners. Internationally, both segments show growing interest in Albania, Greece, Egypt, and the United States.

In 2023, Italian tourists spent approximately €31.6 billion on outbound travel, marking a 21.3% increase compared to 2022. This growth was driven by a rise in holiday-related travel, particularly to non-EU destinations like Japan, and a notable increase in accommodation expenses. The average spending per outbound trip by an Italian traveller in 2023 was approximately €545.

Couples (25–55 years old)

Families with children

Young adults

Seniors

Solo travellers

Social Media (Instagram, YouTube and TikTok)

Friends’ recommendations (Word of Mouth)

Travel agencies

Online travel agencies (OTAs): 34% of Italians use OTAs like Booking.com, Expedia, and eDreams to research and book travel.

Travel Blogs and Influencers

Online Travel Communities and Forums

Newspapers: Corriere della Sera, La Repubblica

Online Media: Turismo.it, Lonely Planet Italia

2–6 Months in Advance: Nearly half (48%) of Italians plan their holidays within this timeframe, especially for major trips like summer vacations.

January Planning: 13% of Italians organize their entire year's holidays in January, a trend particularly prevalent in southern regions and islands.

Last-Minute Bookings: 14% of travellers plan their holidays just one month before departure, often seeking last-minute deals.

73% of Italians search for travel information online when planning holidays.

22% of Italians (approx. 11 million people) book through traditional travel agencies

There is a growing trend of blended behaviour: digital discovery followed by in-person agency booking.

Online travel agencies (OTAs): Volagratis.com

Specialized providers: Hotels.com, Booking.com, Airbnb

In 2023, Italian outbound travellers spent an average of 8.8 nights abroad per trip, reflecting a continued preference for extended stays. The longest durations were recorded for long-haul destinations such as Oceania (26.6 nights), the Caribbean and South America (14.4 nights), and non-EU European countries (13.7 nights). Among specific destinations, Spain stood out with an average of 13.5 nights, followed by Slovenia (9.8) and Germany (8.7). Shorter trips were common for nearby or frequently visited destinations like France (4.8 nights) and Switzerland (5.4).

Alpitour

CartOrange

Boscolo

I Grandi Viaggi (IGV)

I Viaggi di Seve

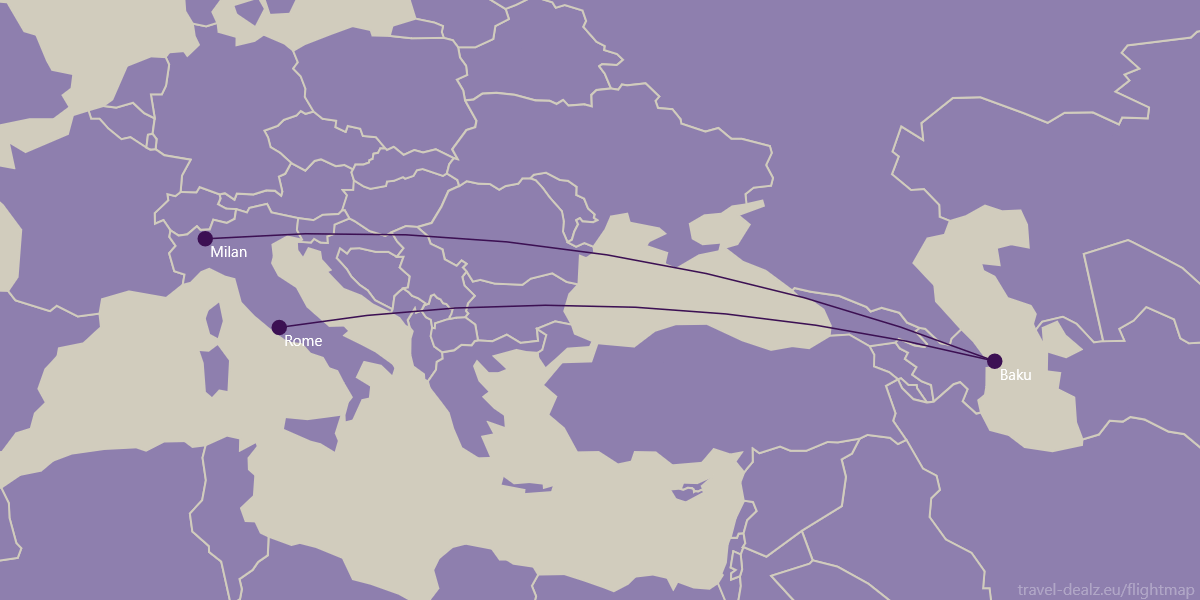

Updated information about flight connectivity can be found on the interactive board of the State Tourism Agency of the Republic of Azerbaijan.

TTG Travel Experience – each October

BIT Milano – each February

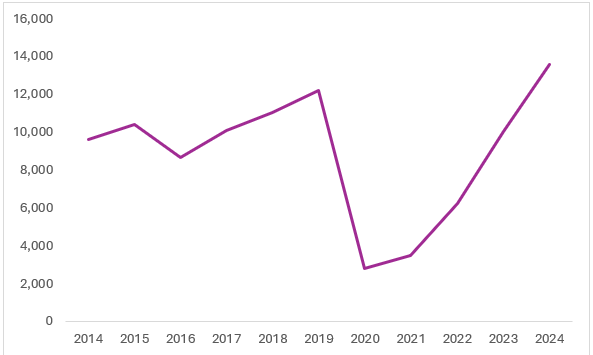

Between 2014 and 2019, the number of Italian tourists visiting Azerbaijan showed a steady upward trend, rising from 9,605 to 12,215 visitors. However, the global COVID-19 pandemic caused a dramatic decline in 2020, with arrivals plummeting to just 2,813, followed by only a modest recovery to 3,493 in 2021. By 2024, the upward momentum culminated in a record 13,582 arrivals, surpassing the 2019 level by more than 11%.

Source: State Migration Service

For Italian tourists, Azerbaijan is predominantly a leisure destination, with 72% of visitors coming for rest and recreation. Business travel is also significant, accounting for 21% of arrivals, reflecting strong economic and professional ties.

In addition to Azerbaijan, Italian tourists show increasing interest in other destinations across the Caucasus and Central Asia, particularly Georgia, Uzbekistan, and Kazakhstan. These countries offer a rich combination of cultural heritage, historical Silk Road cities, and diverse natural landscapes that align with the preferences of Italian travellers seeking authentic and immersive experiences. Georgia attracts visitors with its ancient Christian monuments, traditional gastronomy, and renowned wine regions, while Uzbekistan appeals through its well-preserved historical centres such as Samarkand and Bukhara, key points along the Silk Road. Kazakhstan, with its vast steppes, mountain ranges, and emerging ecotourism offerings, draws Italians interested in adventure and nature-based tourism.

In 2024, Italian tourists spent an average of 2,078.6 AZN per person during their trip to Azerbaijan. The largest portion (47%) was allocated to transportation, followed by accommodation (20%), food (19%), and purchasing gifts or souvenirs (9%).

The majority of Italian travellers stayed in Azerbaijan for short to moderate periods. 42% spent 1–3 nights, and 32% stayed for 4–7 nights. Another 16% extended their stay to 8–14 nights, while only 6% stayed for longer durations, showing that visits are typically brief yet immersive.

Excluding Baku, the top regions for Italian tourists in Azerbaijan are Gabala, Naftalan, Sheki and Shamakhi.

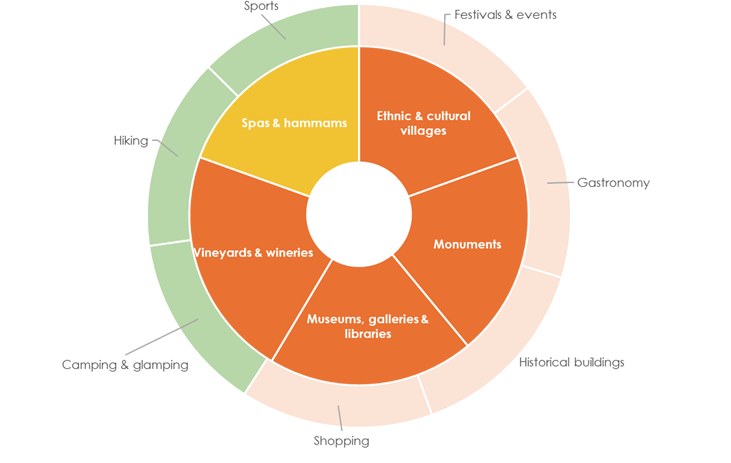

Italian tourists exhibit a strong preference for a variety of cultural and natural experiences connected to the ATB product sub-categories of historical buildings, monuments, museums, galleries & libraries, theatres, cultural & opera houses, and hiking.

Products of Azerbaijan that connect to the Italian market can be grouped into “Fits all” – products that all first-time visitors should see or experience, “Add-ons” – products that can be seen or experienced with longer or repeat visits, and “Tailored” – products that are considered of specific relevance to the market.

|

|

Fits all |

Add-ons |

Tailored |

|

Monuments |

|

|

|

|

Historical Buildings and Sites |

|

|

|

|

Hiking |

|

|

|

|

Museums, Galleries & libraries |

|

|

|

|

Ethnic & Cultural Villages |

|

|

|

|

Arts & Crafts

|

|

|

|

Relationship-building is essential. Italians value personal trust and continuity in business partnerships. Invest time in creating strong one-on-one relationships with travel agencies and tour operators.

Key outreach periods are January to March for early summer planning and September to November for winter and long-haul travel arrangements. Italians often book 1–3 months in advance, but a growing segment plans 3+ months ahead—especially for long-haul or premium trips.

Digital visibility matters. Over 73% of Italians search online before booking; be present on digital channels, price comparison platforms, and via influencer or content-driven marketing to support your B2B efforts.

Focus on product depth, quality, and storytelling. Italians seek immersive cultural experiences, authentic gastronomy, wellness, and meaningful travel.

Primary market hubs to target include Milan, Rome, Turin, Bologna, Florence, and Naples, with additional strong outbound activity from Venice, Verona, and Bari.